INDIANAPOLIS — TheIndiana Department of Revenue (DOR) says the first group of automatic taxpayer refund(ATR) checks should arrive in Indiana mailboxes later this week.

Some Hoosiers began receiving their direct deposits Friday. The DOR tells WRTV overall, the bank is expected to begin issuing the deposits on Friday, August 19. 1.7 million paper checks are being mailed out.

"There are several factors that affect the time it takes for this process that are outside DOR’s control. Some banks are slower to accept outside ACH deposits than others," a DOR spokesperson told WRTV. "We expect most ATR direct deposits to arrive in Hoosier’s bank accounts on or around Aug. 24."

To qualify for the refund, taxpayers would have had to file an Indiana individual income tax return for 2020 with a postmark date of Jan. 3, 2022.

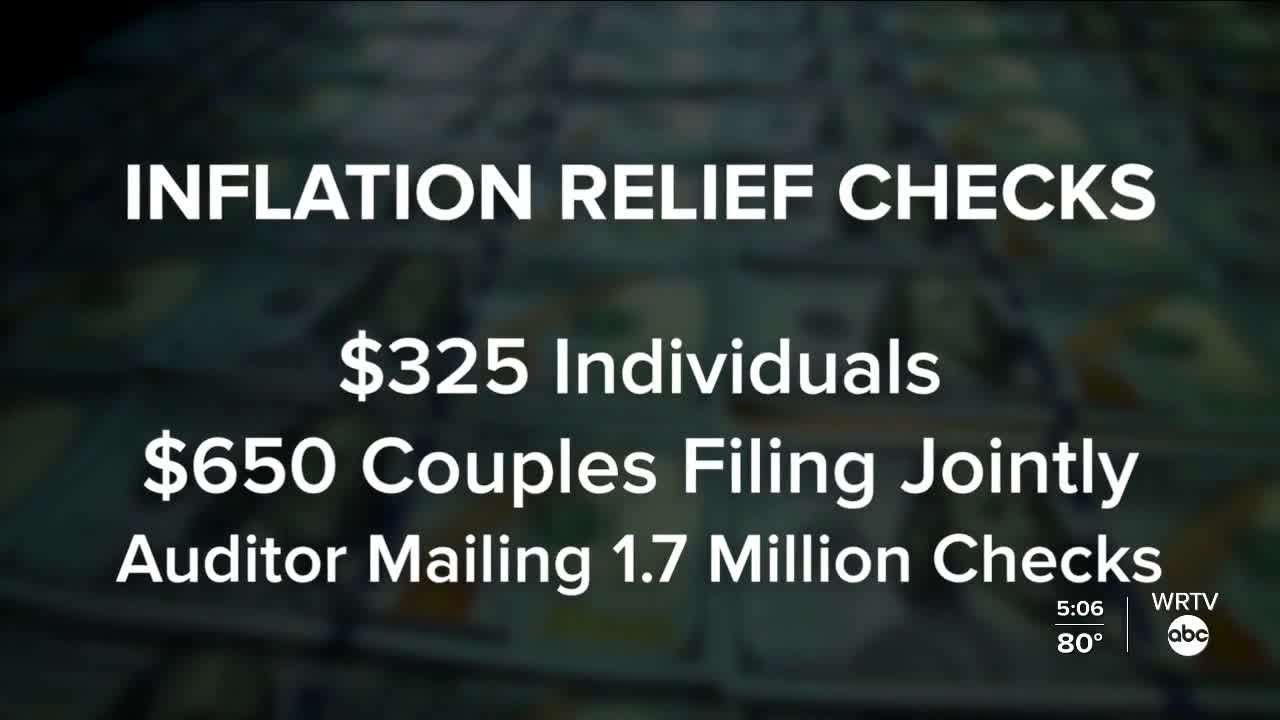

The DOR says how taxpayers receive their $125 and $200 refunds will depend on how they filed their 2021 individual income tax return with the Department. If taxpayers listed direct deposit (checking or savings account) information on their 2021 Indiana income tax refund, they should have already received their $125 direct deposit. If they have not received a direct deposit, they will receive a combined check from the Auditor of State for $325 (or $650 if filed jointly).

If there are issues with direct deposit, the DOR will work with the auditor of state to have the refund issued as a check.

The DOR is asking Hoosiers to hold off on contacting them about ATR payments until Nov. 1. Around that time, information on what to do if you did not receive a refund will be online.

The money is coming from a state budget surplus.

-

Indiana legislative session approaches deadline with major decisions looming

So far, the governor has signed more than 100 bills into law, some of which have sparked controversy.

New grant helping central Indiana schools address students' mental wellness

A new grant from Butler University is working to help school districts around central Indiana, geared toward helping students with mental wellness.

Indiana businesses remain concerned over uncertainty when it comes to tariffs

A survey by the Indiana Chamber gauges the level of concern around proposed tariffs to local businesses. 80% say they’re “concerned”, 65% are “very concerned,” and 20% say they are neutral.

USDA urges states to reinforce work requirements for SNAP recipients

With ongoing discussions about SNAP adjustments, officials stress the importance of work requirements for those receiving aid for food costs.